6 Simple Techniques For Loss Adjuster

Table of ContentsTop Guidelines Of Public AdjusterSome Ideas on Loss Adjuster You Should KnowPublic Adjuster for DummiesSome Known Details About Loss Adjuster Rumored Buzz on Public AdjusterLittle Known Facts About Loss Adjuster.

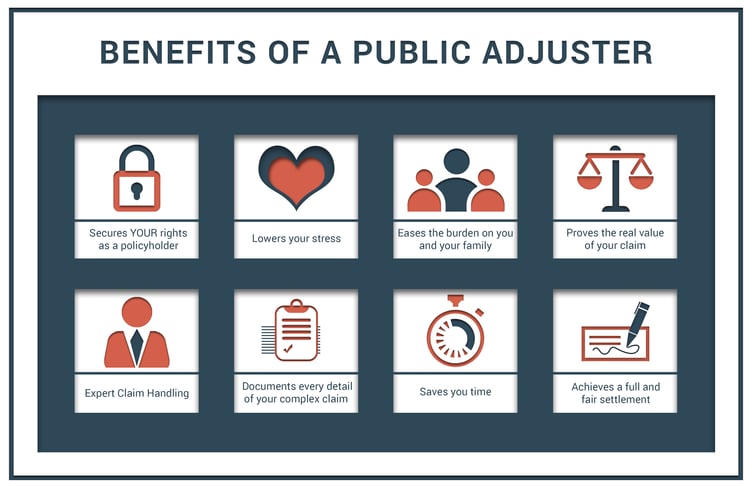

If you wish to see to it that you obtain all the benefits used by your insurance plan as well as the largest negotiation possible, it's worth speaking to a public insurance insurer today! They are specialists that function to get you the most effective negotiation feasible from your insurance firm. They can help determine what is as well as isn't covered by your policy, and they will manage any type of disputes or negotiations on your behalf.There are special kinds of insurance claim insurers: The insurance holders themselves and not the insurance company hire public insurers. Outside adjuster gotten by the insurer. Generally from large corporations who consent to the insurer's pre-set procedures. Staff insurers are hired by the insurer. They are either outside service providers or regularly function within the business itself (property damage).

Out of all the classes of insurance coverage claim insurance adjusters, public insurers are the only ones who are independent of insurance coverage companies. They are employed by the policyholder to look at the claim and also to ensure that they get the right amount of cash. The goal is to get the insurer to cover the entire damage or loss to their structures or building from a calamity or crash.

More About Public Adjuster

They were put into area to make certain that insurance provider would pay all cases from customers and not attempt to reduce prices by underpaying for an insurance claim or denying it altogether. The public insurance adjuster's task is easy: they evaluate your policy, identify what you are owed, and afterwards deal with on your part to get the complete settlement.

If you have a home mortgage, the lien owner likewise will be a payee, as will any type of various other parties with insurable passions. A public adjuster acts as your rep to the insurer. Their purpose is to navigate all phases of the insurance claim procedure as well as supporter for the very best passions of the insured.

All about Property Damage

This allows the insured to concentrate on other, more crucial jobs rather than dealing with the tension of insurance coverage settlements. This is specifically useful in the days and weeks following a loss. There are various responsibilities that public insurers do for the insurance holder: Determine Protection: Examine and also check out the insurance coverage plan as well as identify what coverage and limits use.

Some insurance coverage insurers have more experience as well as will certainly do a far better job. It's always handy to ask for referrals or to see a checklist of to assess the insurer's capacity. Not all insurance policy declares follow a collection course. There are constantly differences and also problems that need to be browsed. An experienced insurance adjuster needs to prove 3 points: Loss conditions meet the criteria for insurance coverage.

Facts About Property Damage Revealed

That the negotiation quantity will totally recover the insurance holder's property to pre-loss problem. Any recommendation that confirming these things is easy, or that a computer can do it for you, just isn't real. Cases really promptly come to be a twisted mess due to the fact that the: Loss problems are not plainly mentioned, not properly evaluated and documented, or they consist of multiple causes or numerous plans.

If the loss is significant, you might want to get to out to a public insurance coverage adjuster. You should alert your insurance coverage company as quickly as possible.

Understand that they will certainly be assessing just how much you recognize about your plan limits, the damages you have suffered and also if you are recommended you read wanting to a representative, public adjuster or insurance service provider for guidance. A public insurance adjuster damages the assessment cycle, stepping in as your special specialist representative. With a level having fun area, great deals of paperwork, and iron-clad proof of all assessments, it is difficult for the insurance coverage company to suggest for anything much less than a complete and fair settlement.

Public Adjuster Can Be Fun For Everyone

The graph below shows some of the extra modest claims that we have actually helped to clear up. As you can see in every instance we made our clients at the very least double the quantity of the original insurance firm deal. loss adjuster.

Keep in mind that there is a whole lot at stake, and the insurance business why not look here has lots of experience in managing results. When disagreements arise, your public insurance adjuster will certainly know what to do and function to settle the problem effectively.

If the loss is considerable, you might desire to reach out to a public insurance coverage adjuster. You should notify your insurance firm as quickly as possible.

The Buzz on Property Damage

The chart listed below reveals some of the more modest cases that we have actually helped to resolve. As you can see in every circumstances we made our customers at the very least dual the quantity of the original insurance coverage firm offer.

Remember that there is a lot at stake, as well as the insurance coverage company has lots of experience in regulating end results. When disagreements develop, your public insurance adjuster will know what to do and Recommended Reading function to settle the problem efficiently.